Published as Mathematical operations with the Normal distribution, corp.ling.stats

In my Made in Westminster post I summarised a financial and political analysis of the USS pension deficit. I also run a blog for discussing statistics in corpus linguistics, and it is there that I have published my working (unlike UUK).

Case study: The declared ‘deficit’ in the USS pension scheme

At the time of writing nearly two hundred thousand university staff in the UK are active members of a pension scheme called USS. This scheme draws in income from these members and pays out to pensioners. Every three years the pension is valued, which is not a simple process. The valuation consists of two aspects, both uncertain:

- to value the liabilities of the pension fund, which means the obligations to current pensioners and future pensioners (current active members), and

- to estimate the future asset value of the pension fund when the scheme is obliged to pay out to pensioners.

What happened in 2017 (and happened in the last two valuations) is that the pension fund has declared itself to be in deficit, meaning that the liabilities are greater than the assets. However, in all cases this ‘deficit’ is a projection forwards in time. We do not know how long people will actually live, so we don’t know how much it will cost to pay them a pension. And we don’t know what the future values of assets held by the pension fund will be.

The September valuation

In September 2017, the USS pension fund published a table which included two figures using the method of accounting they employed at the time to value the scheme.

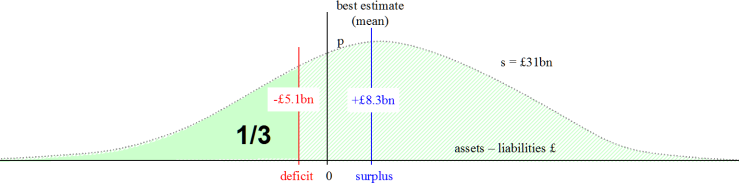

- They said the best estimate of the outcome was a surplus of £8.3 billion.

- But they said that the deficit allowing for uncertainty (‘prudence’) was –£5.1 billion.

Now, if a pension fund is in deficit, it matters a great deal! Someone has to pay to address the deficit. Either the rules of the pension fund must change (so cutting the liabilities) or the assets must be increased (so the employers and/or employees, who pay into the pension fund must pay more). The dispute about the deficit is now engulfing UK universities with strikes by many tens of thousands of staff, lectures cancelled, etc. But is there really a ‘deficit’, and if so, what does this tell us?

The first additional bit of information we need to know is how the ‘uncertainty’ is generated. In February 2018 I got a useful bit of information. The ‘deficit’ is the lower bound on a 33% confidence interval. This is an interval that divides the distribution into thirds by area. One third is below the lower bound, one third above the upper bound, and one third is in the middle. This gives us a picture that looks something like this:

Of course, experimental statisticians will never use such an error-prone confidence interval. We wouldn’t touch anything below 95%! To make things a bit more confusing, the actuaries talk about this having a ‘67% level of prudence’ meaning that two-thirds of the distribution is above the lower bound. All of this is fine, but it means we must proceed with care to decode the language and avoid making mistakes.

In any case, the distribution of this interval is approximately Normal. The detailed graphs I have seen of USS’s projections are a bit more shaky (which makes them appear a bit more ‘sciency’), but let’s face it, these are projections with a great deal of uncertainty. It is reasonable to employ a Normal approximation and use a ‘Wald’ interval in this case because the interval is pretty much unbounded – the outcome variable could eventually fall over a large range. (Note that we recommend Wilson intervals on probability ranges precisely because probability p is bounded by 0 and 1.)